Futures Trading – Resources & Products from IBKR

PRODUCTS

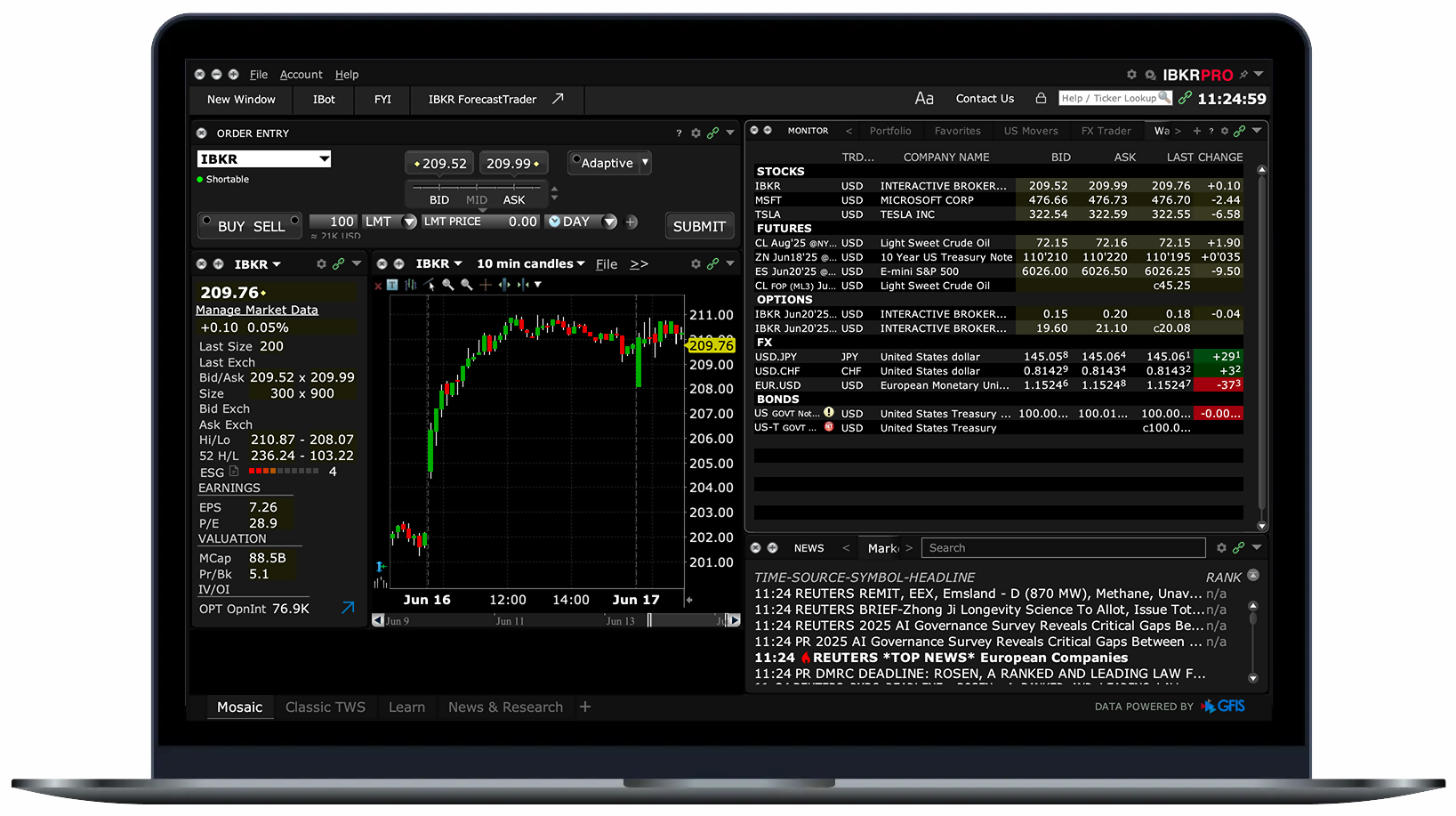

Trade Futures Worldwide with Professional Tools and Platforms

The IBKR Advantage

- Cost efficiency and price transparency: Ultra-competitive commissions and margin financing costs among the lowest in the industry.

- Breadth of offering: Trade futures, plus micro and mini futures, on indices, interest rates, currencies, commodities and cryptocurrencies across 30+ exchanges globally.

- Professional Technology and Execution Quality: Advanced desktop, mobile and web trading platforms offer low-latency access and best execution support from IB SmartRoutingSM. In addition, our powerful REST, Python, Java and C++ APIs let you build your own custom trading systems.

- Robust Risk Controls: Real-time risk monitoring, risk analytics and customizable alerts help with managing complex portfolios and optimizing capital by adjusting margin requirements based on overall risks.

- Financial Strength: IBKR’s self-clearing structure reduces reliance on third parties, while our strong capital position helps ensure long-term platform and counterparty strength.

Why Trade Futures through Interactive Brokers?

Advanced Platforms and Tools

Utilize powerful tools like Trader Workstation (TWS) and ComboTrader for seamless futures trading.

Leverage 100+ order types, algorithms, and tools like the Index Arbitrage Meter for advanced strategies.

Free Resources via IBKR Campus

Extensive futures trading courses and educational resources are available on IBKR Campus.

Here you can learn about trading, financial markets and Interactive Brokers trading tools.

Find Opportunity Across Markets and Asset Classes

Engage in global futures trading across more than 30 market centers to safeguard against price variations in commodities, currencies, or interest rates. You can also speculate on price changes in the underlying asset, amplify your position, or broaden your investment portfolio.

Agriculture

Cryptocurrency

Currencies

Energy

Equity Indices

E-mini and Micro E-mini Futures

Fixed Income

Interest Rates

Metals

Softs

Volatility Indices

Professional Trading Platforms to Help You Succeed

Our award-winning platforms* offer powerful trading features and streamline solutions for all traders. IBKR offers desktop, mobile and online trading platforms with no platform fees.

Execute Your Futures Strategy with the Help of Powerful Trading Tools

Our trading platforms include powerful futures trading tools to help you implement your unique trading strategy.

Over 100 order types, ranging from limit orders to intricate algorithmic trading, assist you in implementing any trading approach.

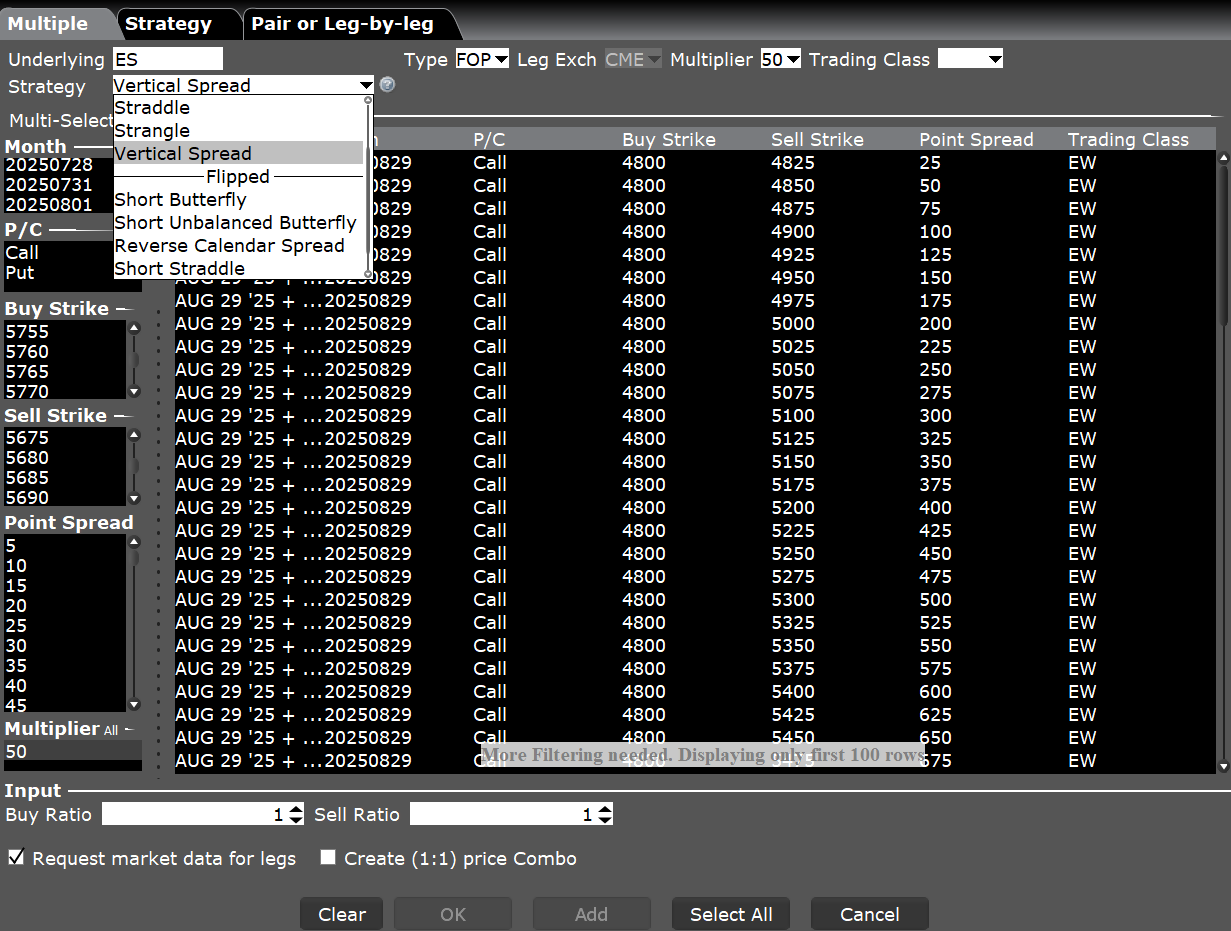

Create proprietary combination order strategies or choose from multiple templates with pre-defined programs to execute futures trades.

Seamlessly integrated into Trader Workstation (TWS), SpreadTrader is the single-screen command center for managing futures positions.

Evaluate index arbitrage tactics using our Index Arbitrage Meter, a tool that demonstrates the disparity between futures contracts and their corresponding spot prices.

#1 Futures Trading

Best Futures Broker

*For information on accolades received, visit our awards page.

Benefits of Trading Futures

Futures trading offers investors a seamless way to hedge, speculate and gain exposure to multiple asset classes. Each exchange offers a unique set of products enabling the investor to get precisely the right exposure to specific commodity prices or financial assets.

Around-the-Clock Trading Opportunities

- Most exchanges enable investors to trade continuously across different time zones and have extensive trading hours throughout the week. This allows traders and investors the ability to react quickly to unexpected changes in market conditions or global news events outside of regular trading hours.

Direct Market Exposure

- Futures as an asset class are important because the underlying commodity or product generally act as a barometer for the health of the macro economy. Prices tend to change based upon rising demand or shrinking supplies of specific goods.

- Traders use commodity markets tied to goods that are used in manufacturing, building and to power economies. Many traders tend to buy and sell commodity futures aiming to capitalize on advantageous price movements in response to changing news about the global economy.

- As the global economy picks up steam, commodity prices tend to rise offering speculators direct exposure to a physical commodity without ever having to own it. Through the economic value chain, changes in commodity prices can have immediate impact on stock indices, foreign exchange rates, interest rates and food items. To this extent, futures markets are unrivaled.

Capital Efficiency

- Futures trading occurs in a margin account. A commodities broker freezes an amount per contract set by the exchange in a client’s account in order to maintain a position in the futures market.

- As the price of the future fluctuates, changes in the value of the futures contract are credited to or debited from the client’s account. The amount of margin frozen by the broker is used to protect it and the exchange from excessive losses should the price of the contract move adversely.

- Margin accounts are typically associated with the idea of leverage, which means that a smaller amount of capital maybe used to control a larger underlying investment. The associated leverage in the futures market depends upon how volatile each commodity or financial asset has been over its recent history.

- Generally speaking, futures contracts may allow leverage of four-to-one, which means that $25,000 in margin will allow control over $100,000 worth of an underlying asset. This makes futures markets capital efficient.

Potential Tax Benefits

- The US IRS has designated certain regulated futures contracts (RFCs), as well as options on futures contracts, as subject to preferential tax treatment, offering additional tax benefits to futures traders.

- The IRS includes RFCs, stock index and futures, options on US broad-based indices as well as certain Cboe-listed exchange traded funds and exchange trade partnership contracts as being subject to section 1256 of its code. Section 1256 contracts enjoy lower 60/40 capital gains rates of taxation under which 60% are subject to lower-longer term capital gains tax rates, and 40% are subject to short-term capital gains deducted at the ordinary tax rate.

- As an example, using the maximum tax bracket for 2023/24, the blended 60/40 rate of 26.8% in 10.2% lower than the highest regular tax bracket of 37%. Section 1256 treatment of certain futures contracts means that there are significant tax savings across various income tax brackets.

- Since Section 1256 contracts are subject to so-called ‘mark-to-market’ reporting, for tax purposes MTM reports both realized activity throughout the year and unrealized gains and losses on still open futures trades at the end of the year.

The risk of loss in online trading futures can be substantial. Before trading security futures, read the Security Futures Risk Disclosure Statement.

What are Futures?

A futures contract is a standardized agreement between a buyer and a seller covering a fixed amount of a specific physical product of an agreed upon quality and quantity. A futures market enables buyers and sellers to reach an agreement on the price of something today for a product or commodity that will be available at a later date.

Due to deep liquidity across exchanges and convenient around-the-clock trading, futures markets are often accessed by investors for both hedging and speculation in and outside of market hours.

Futures contracts were originally designed to enable farmers to lock into prices today for crops that were not yet planted.

For financial futures, the contract covers a specific number of shares or cash value of an agreed upon underlying index or financial asset. Futures generally trade upon a futures exchange, which creates, designs and lists each contract.

The exchange attracts willing buyers and sellers who together ensure liquidity for each product. Integral to any exchange is a clearing house whose role is to guarantee the contract and so eliminate the risk of any market participant from failing to fulfill their obligations.

Other Aspects of Futures

Futures contracts are so-called since they are an agreement to fulfill a specific obligation by a certain point in time, as laid down in the contract. This feature enables buyers and sellers to agree a price today for something that may not yet be made, or may only become available at some later point in time.

Futures markets include corn, wheat and soybeans whose prices vary substantially according to the weather during the growing season. Energy futures contracts include crude oil, natural gas and electricity, where power plants can lock-in demand in the coming months at prices displayed today.

Equity index futures and government bond futures markets have also become critically engrained in institutional and retail investors’ behavior with good reason. Due to deep liquidity across exchanges and convenient around-the-clock trading, futures markets are often accessed by investors for both hedging and speculation in and outside of market hours.

Interactive Brokers’ Education and Resources for Futures

Futures are standardized contracts for buying or selling assets at a set price on a future date. Traders Academy by Interactive Brokers provides complimentary courses to educate you on futures and their role in facilitating trading, hedging, diversification, and speculation. Available courses include:

Introduction to Futures

This course provides lessons on the mechanics of the futures market, the risks inherent in futures trading and the financial markets, and defines “the basis” of futures pricing. As the course progresses, you will review topics such as Contango and Backwardation, futures exchanges and contracts, and go in-depth on futures margin and trading futures contracts in Trader Workstation (TWS).

IBKR Campus Futures Content

Access free futures trading education, including expert-led video courses, webinars, podcasts and the latest trends in financial news. We also offer more specialized courses on CME Micro WTI Crude Oil Futures and South American soybean futures, as well as an introduction to grains and oilseeds.

Futures Fundamental Analysis

Fundamental analysis is the process of determining the model price of a futures contract, now and in the future, using factors like micro economic data, macro-economic data, and industry financial conditions. This course, provided by CME Group, will explain the idea of Fundamentals Analysis. It will also show how this analysis relates to equity indices, energy, interest rates, foreign exchange, agriculture, and metals.